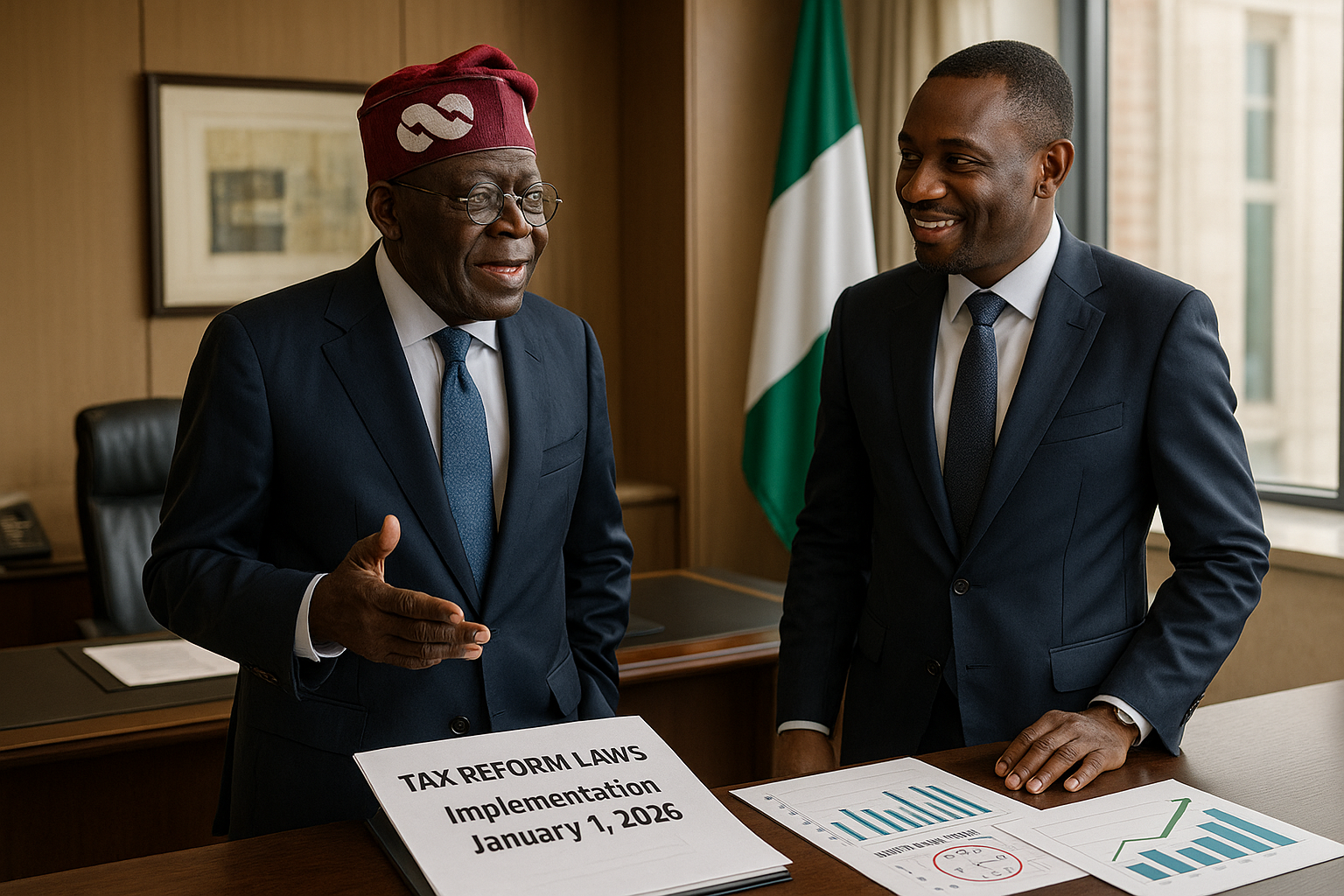

The Federal Government of Nigeria has reaffirmed its commitment to implementing key tax reform laws starting January 1, 2026, despite ongoing procedural reviews by the National Assembly. Taiwo Oyedele, chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, stated that preparations are on track following a briefing with President Bola Tinubu. The reforms aim to ease the tax burden on most Nigerians while promoting economic growth.

Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, addressed concerns over Nigeria's tax reforms during a briefing in Lagos on December 26, 2025, after meeting President Bola Tinubu. He emphasized that the government remains committed to the full rollout of the four landmark laws on January 1, 2026, describing them as 'people-focused and growth-driven.'

Two of the acts—the Nigerian Revenue Service (Establishment) Act and the Joint Revenue Service (Establishment) Act—have been in effect since June 26, 2025. The remaining two, the Nigerian Tax Act and the Nigerian Tax Administration Act, are set to commence as scheduled. 'We met with Mr President to provide an update on the implementation of the tax reform laws. Two of the laws have already commenced, while the remaining two are on track to take effect on January 1, 2026,' Oyedele said.

Amid public outrage over alleged discrepancies in the bills' passage, the National Assembly issued a statement clarifying the process. Concerns focused on harmonization between Senate and House versions, documents sent for presidential assent, and published acts. The legislature, through Director of Information Bullah Audu Bi-Allah, announced an internal review of procedures in compliance with the Constitution and parliamentary rules. It directed the Clerk to re-gazette the acts and provide certified copies upon request.

The review is administrative and does not imply defects in legislative authority, the statement noted, urging the public to avoid speculation. Oyedele welcomed the House of Representatives' intervention, adding, 'The Federal Government will continue to engage constructively with the National Assembly... However, the implementation timeline remains unchanged.'

The reforms are designed to benefit most citizens: about 98 percent of workers will pay no or reduced personal income tax, and 97 percent of small businesses will be exempt from corporate income tax, VAT, and withholding tax. Larger firms will see lower effective rates. 'The whole idea is to promote economic growth, inclusivity and shared prosperity,' Oyedele explained. Preparations began in October 2024, involving capacity building and system upgrades. Revenue growth is expected from a broader tax base, not higher rates, fostering sustainable compliance and equity.