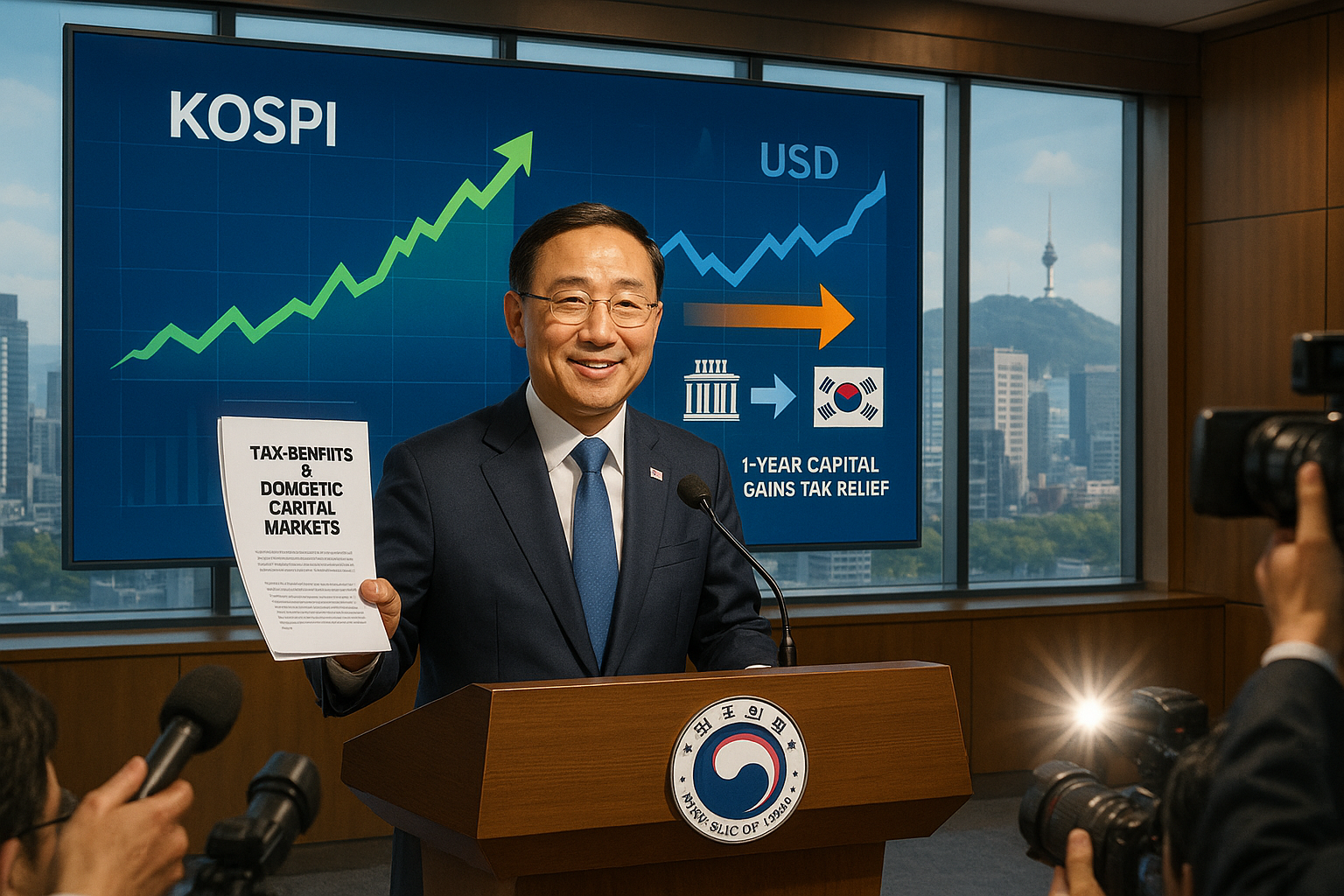

The finance ministry announced a package of tax benefits on Wednesday to revitalize the domestic capital market and ease structural imbalances in the foreign exchange market. The measures address the ongoing increase in domestic investors' overseas asset holdings amid the prolonged weakness of the Korean won against the U.S. dollar. Individual investors selling overseas stocks and reinvesting in domestic equities long-term will receive temporary tax relief on capital gains for one year.

On December 24, 2025, the Ministry of Economy and Finance announced tax benefits to reverse the trend of domestic investors expanding their overseas asset holdings. This comes as the Korean won approaches its weakest level against the U.S. dollar in 16 years, aiming to curb capital outflows and strengthen the domestic market.

Key measures include providing temporary tax relief for one year on capital gains from overseas stock sales for individual investors who convert proceeds to Korean won and make long-term investments in domestic equities. The relief will be applied on a differentiated basis depending on reinvestment timing, with specifics to be finalized after further review. Additionally, the government will support major brokerage firms in quickly launching forward-selling products for retail investors to address the lack of tools for managing foreign exchange risks.

To reduce double taxation on dividends received by domestic parent companies from overseas subsidiaries, the dividend income exclusion ratio will be raised from 95 percent to 100 percent. The ministry stated, "While the domestic stock market has shown one of the strongest performances among global capital markets this year, individual investors' overseas stock investments have surged, whereas investment in domestic equities has declined." The benchmark Korea Composite Stock Price Index (KOSPI) has surged about 70 percent so far this year, driven by government-led market reform measures and optimism surrounding the AI boom.

The ministry noted growing calls for measures to encourage the repatriation of overseas assets held by exporters and other companies to attract domestic employment and investment. Earlier that day, it issued a verbal intervention stating that an excessively weak Korean won was undesirable and that the market would soon see the government's strong commitment and capacity for comprehensive policy measures to stabilize the local currency.