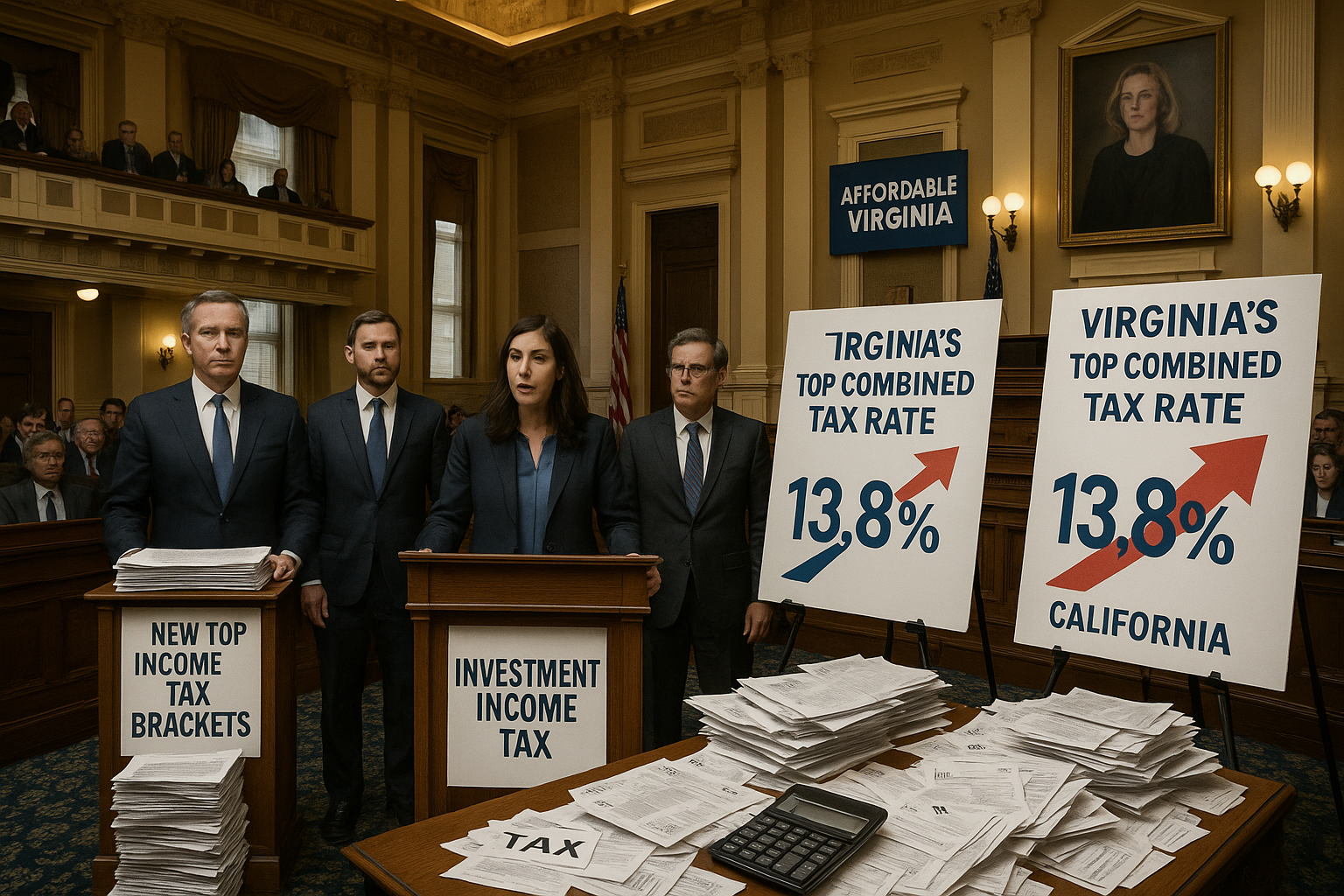

Virginia Democrats have introduced legislation that would add new top income-tax brackets and impose an additional tax on certain investment income, changes that supporters and critics say could push the state’s top combined rate to roughly 13.8%—potentially higher than California’s. The proposals arrive as Democrats hold majorities in both legislative chambers and as newly inaugurated Gov. Abigail Spanberger emphasizes an “Affordable Virginia” agenda focused on lowering household costs.

Shortly after Democrats began the 2026 legislative session with control of both chambers in Richmond, lawmakers introduced measures to create new high-income brackets and to add a separate tax on certain investment income. A Daily Wire report said the combined effect could lift Virginia’s top effective rate to about 13.8%, a level it said would exceed California’s current top state income-tax rate.

Supporters have framed the changes as a “fair share” approach aimed at raising money for public priorities. The Daily Wire reported that Del. Kelly Convirs-Fowler said the proposals would require “millionaires [to] pay their fair share of taxes,” and argued the additional revenue would help “buffer” Virginians from broader economic pressures.

The Commonwealth Institute, a progressive policy group that has advocated for creating a new tax bracket on taxable income above $1 million, has said such a “Fair Share” tax could raise more than $1 billion per year, with the revenue used for areas such as public education and housing.

The debate comes as Spanberger, who was sworn in as Virginia’s governor on January 17, 2026, has highlighted affordability—especially in health care, housing and energy—as a central focus of her administration. During her campaign, her platform said an “Affordable Virginia Plan will lower costs, save Virginians money, and make it easier for people who work hard to get ahead,” and the Daily Wire reported she pledged to lower health care, energy and housing costs in 2026.

Republicans and conservative advocacy groups have argued that the tax proposals conflict with that affordability message. The Daily Wire reported that House Minority Leader Terry Kilgore characterized the measures as part of a slate of “bad bills,” and that the Republican Party of Virginia warned Spanberger’s approach would take Virginia down the “same failed path as California and New York.”

Grover Norquist, president of Americans for Tax Reform, said in comments carried by the Daily Wire that raising taxes now is “particularly foolish” amid what he described as increased competition among states.

The Daily Wire also reported that the Congressional Leadership Fund, a Republican-aligned group, criticized the speed of the push and said that “within 48 hours of taking power” Democrats introduced legislation “creating new sales and retail taxes.” The group argued the broader package would raise costs, deter investment and make it “very, very expensive to live, work, and raise a family in Virginia.”

Democrats hold a 64–36 majority in the House of Delegates and a 21–19 majority in the state Senate, giving them the votes needed to advance legislation if the caucus remains largely unified. How far the tax proposals move—and whether they become a central political issue heading toward the 2026 midterm elections—may depend on legislative negotiations and how voters weigh competing claims about affordability and public spending.