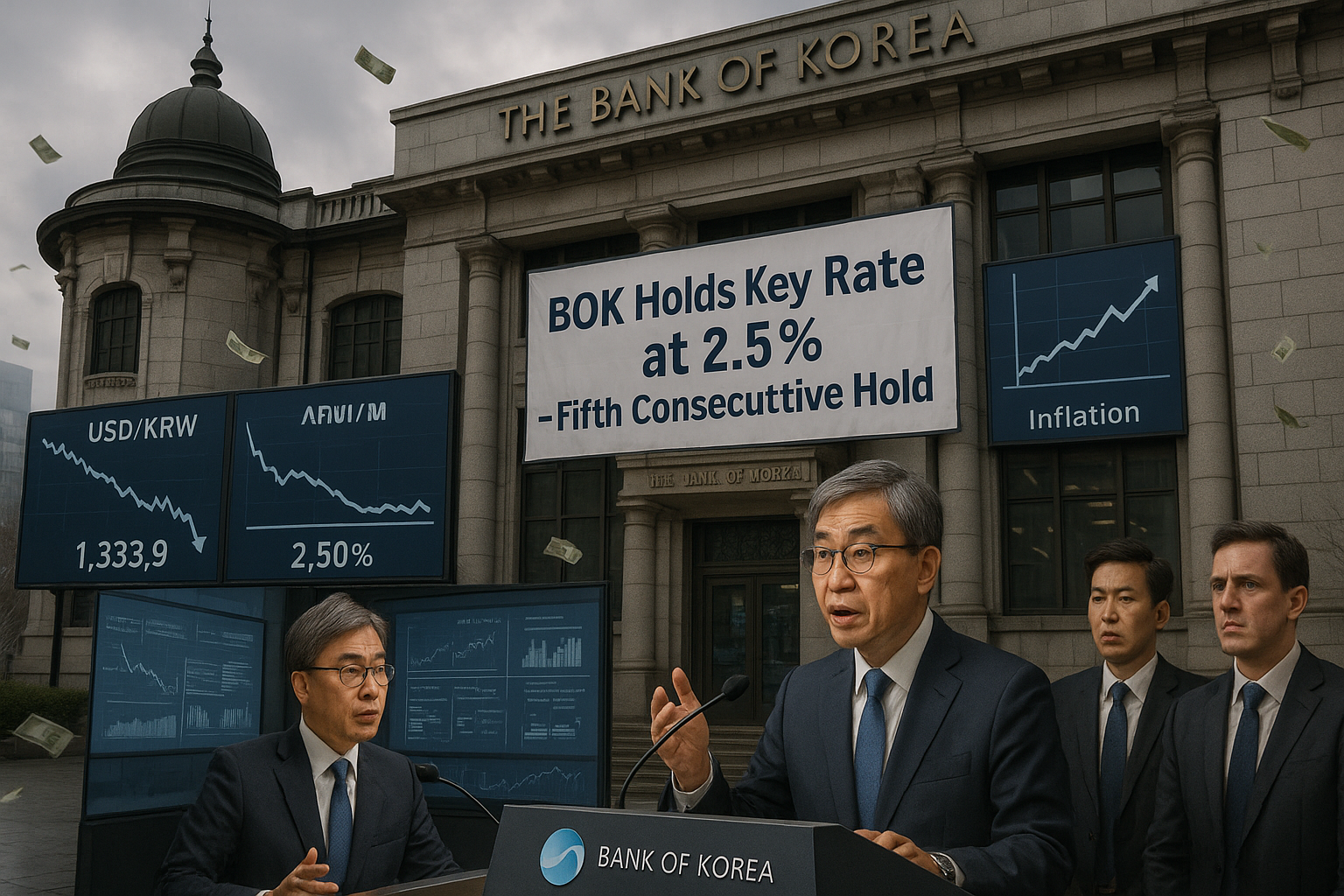

South Korea's central bank decided to keep its benchmark interest rate at 2.5 percent during a monetary policy meeting in Seoul on January 15. This marks the fifth consecutive hold since July, driven by a weakened won and inflation concerns that limit further easing. BOK Governor Rhee Chang-yong emphasized a data-driven approach, leaving room for potential rate cuts in the next three months amid high uncertainty.

The Bank of Korea's Monetary Policy Board unanimously decided to maintain the benchmark interest rate at 2.5 percent on January 15. This is the fifth consecutive hold since July, following a cumulative 100 basis point cut from 3.5 percent since entering an easing cycle in October 2024. The BOK statement noted that inflation is expected to decline gradually, but the elevated exchange rate poses upside risks, while financial stability concerns persist around housing prices in Seoul and surrounding areas, household debt, and exchange rate volatility.

Governor Rhee Chang-yong said in a briefing, "Beyond the three-month time frame, uncertainty remains too high to make any definitive call." He highlighted upside factors for economic growth but stressed inflation's sensitivity to the exchange rate and elevated uncertainty over U.S. monetary policy. Rhee added, "The Korean won is markedly undervalued relative to the country's economic fundamentals and its current level cannot be justified by fundamentals alone."

About three-quarters of the won's weakness stems from a strong U.S. dollar, weak Japanese yen, and geopolitical risks, with the remaining quarter from domestic factors like sharp rises in overseas securities investments by local investors. The won fell to the mid-1,480 range per dollar late last month—nearing a 16-year low—before interventions pushed it to 1,420, but it has since declined for 10 straight sessions to 1,477.5, the longest losing streak since the 2008 global financial crisis. Experts warn a rate cut could spur capital outflows and worsen currency pressure.

Consumer prices rose 2.3 percent year-on-year in December, above the 2 percent target for a fourth month, while import prices increased for a sixth straight month despite falling global oil prices—the first such streak since 2021. The BOK is assessing the impact of government measures tightening home purchases and lending in Seoul since October 15, though apartment prices rose 0.18 percent in early January, extending a 48-week uptrend since February 2025.

The economy is projected to grow 1.8 percent this year, up from 1 percent last year, supported by strong exports and recovering private consumption. U.S. Treasury Secretary Scott Bessent remarked this week that the won's depreciation does not align with South Korea's "strong" fundamentals and excessive forex volatility is undesirable. The BOK will monitor domestic and external conditions to shape future policy while supporting growth recovery.