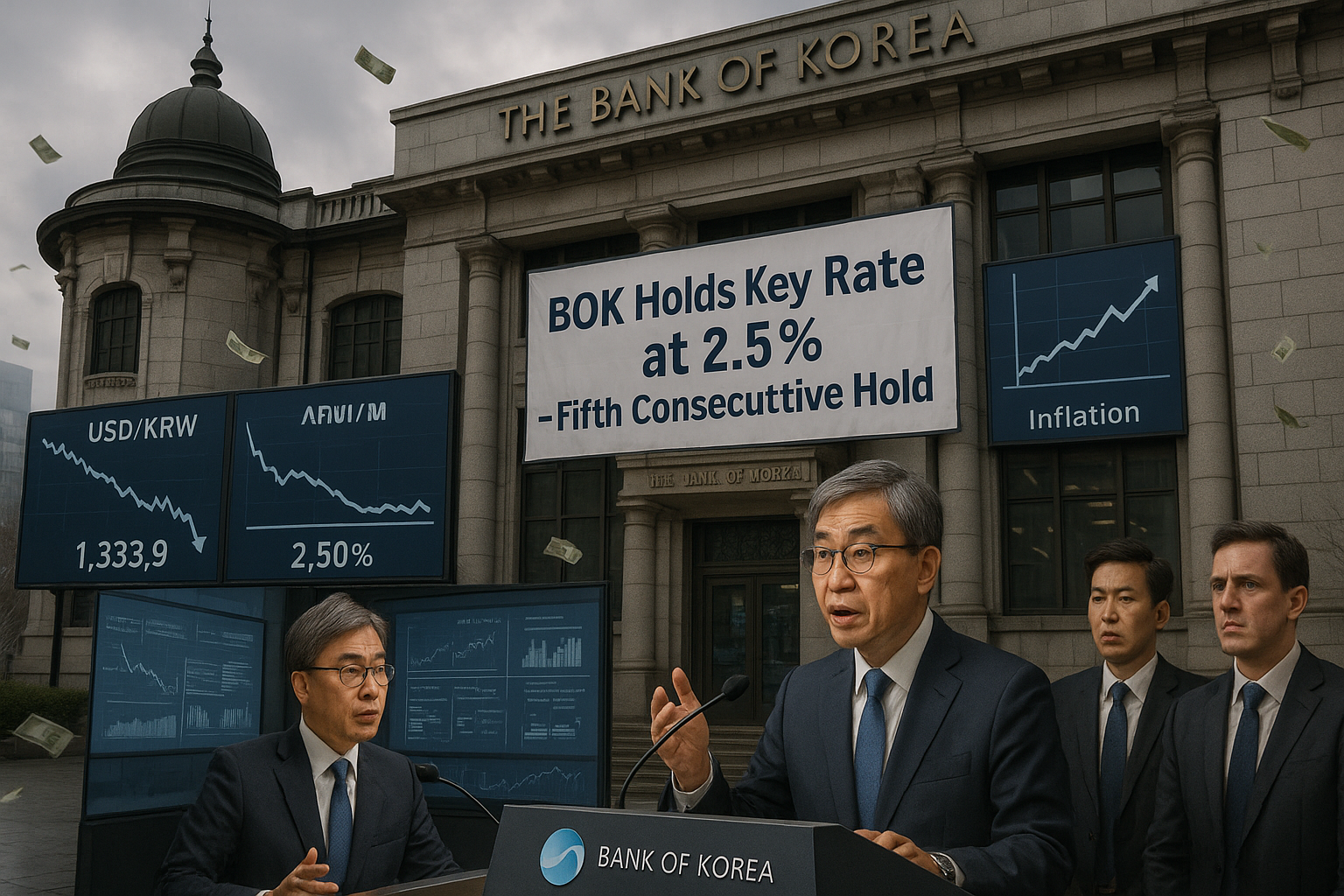

韩国央行于1月15日在首尔召开货币政策会议,决定将基准利率维持在2.5%。这是自7月以来连续第五次维持利率不变,受韩元疲软和通胀担忧影响,限制了进一步宽松的空间。韩国央行行长李昌镛强调数据驱动的方法,在高不确定性下,为未来三个月可能的降息留有空间。

韩国央行货币政策委员会一致决定于1月15日维持基准利率在2.5%。这是自7月以来连续第五次维持利率不变,此前自2024年10月进入宽松周期以来,已累计降息100个基点,从3.5%降至当前水平。韩国央行声明指出,通胀预计将逐步下降,但汇率高企带来上行风险,同时首尔及周边地区房价、家庭债务和汇率波动等金融稳定担忧持续存在。行长李昌镛在简报会上表示:“超出三个月的时间框架,不确定性仍过高,无法做出明确判断。”他强调经济增长的上行因素,但指出通胀对汇率敏感,且美国货币政策不确定性高。李昌镛补充道:“韩元相对于韩国经济基本面明显被低估,其当前水平无法仅用基本面解释。”韩元疲软约四分之三源于美元走强、日元疲软和地缘政治风险,其余四分之一来自国内因素,如本地投资者海外证券投资急剧增加。韩元上月底跌至1美元兑中1480区间,逼近16年低点,随后干预将其推升至1420,但之后连续10个交易日下跌至1477.5,创2008年全球金融危机以来最长连跌纪录。专家警告,降息可能刺激资本外流,加剧货币压力。12月消费者价格同比上涨2.3%,连续第四个月高于2%的目标,尽管全球油价下跌,进口价格仍连续第六个月上涨——这是自2021年以来首次出现此类连涨。韩国央行正在评估政府自10月15日起收紧首尔购房和贷款措施的影响,尽管如此,公寓价格在1月初上涨0.18%,延续自2025年2月以来48周上涨趋势。今年经济增长预计为1.8%,高于去年1%,得益于出口强劲和私人消费复苏。美国财长斯科特·贝森特本周表示,韩元贬值不符合韩国“强劲”基本面,过度外汇波动不可取。韩国央行将监测国内外状况,以塑造未来政策,同时支持增长复苏。