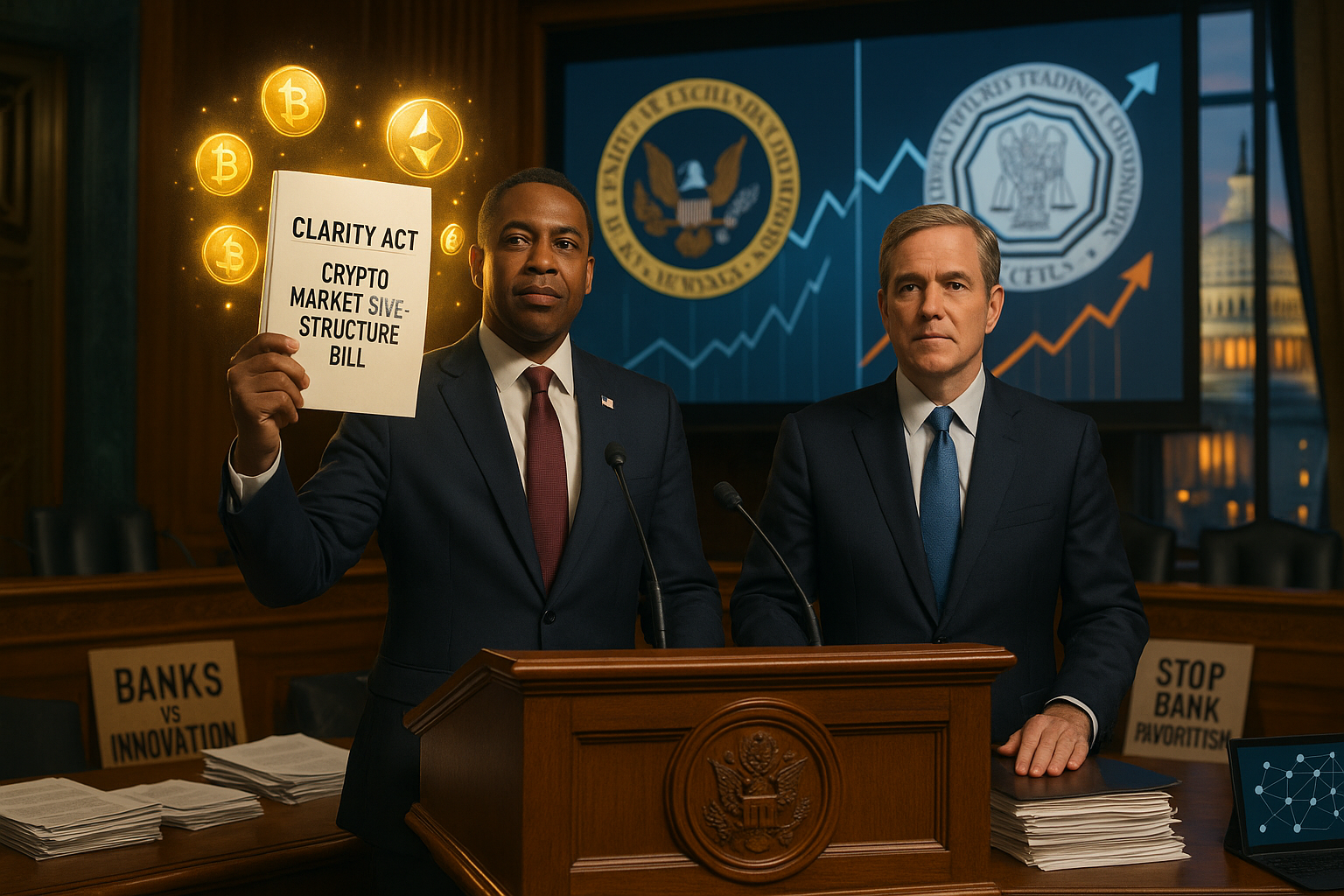

US senators introduced a draft bill on January 13, 2026, aimed at creating a regulatory framework for cryptocurrencies, clarifying jurisdiction between the SEC and CFTC. The Clarity Act seeks to boost digital asset adoption but faces criticism over provisions favoring banks and insufficient investor protections. A markup session is scheduled for January 15 in the Senate Banking Committee.

On January 13, 2026, US senators unveiled the Digital Asset Market Clarity Act, a long-awaited draft legislation designed to establish a regulatory framework for the cryptocurrency sector. The bill, published by the Senate Banking Committee, clarifies the roles of financial regulators: the Securities and Exchange Commission (SEC) would oversee 'ancillary assets'—crypto tokens whose value depends on issuer efforts—while the Commodity Futures Trading Commission (CFTC) would regulate most other digital commodities, including spot markets.

The legislation addresses key industry concerns by allowing banks broad engagement with digital assets, including trading, lending, and even proprietary trading for financial holding companies, subject to safety and soundness rules. It also provides protections for developers of non-custodial software, shielding them from money transmission prosecutions, a win for DeFi proponents following cases like Tornado Cash co-founder Roman Storm's conviction.

However, the bill bans passive yield on stablecoin holdings, a provision decried by crypto advocates as a concession to banks that could undermine dollar-based stablecoins' competitiveness. 'If Congress weakens dollar-based stablecoins by banning rewards to protect legacy revenue, it hands foreign central bank digital currencies a competitive advantage,' wrote Blockchain Association Executive Vice President Dan Spuller on X.

Opposition mounted quickly. The Consumer Federation of America (CFA) urged lawmakers to halt work on the bill amid a criminal probe into Federal Reserve Chair Jerome Powell, initiated by the Trump administration. CFA Investor Protection Director Corey Frayer warned in a letter that proceeding risks market stability: 'Until the President rescinds his attempt to undermine objective and evidence-based decision making... you must withhold your support of any financial deregulatory bills.'

A coalition of over 260 civil society groups echoed these concerns, sending a letter demanding enforceable measures against crypto fraud, corruption, financial instability, and environmental impacts from mining. 'The Senate has a responsibility to safeguard the resiliency of the American economy... but this bill is just a giant giveaway for crypto oligarchs,' said Jennifer Tanner with Indivisible Action Coalition.

The bill's markup is set for January 15, 2026, with a parallel version under negotiation in the Senate Agriculture Committee expected by month's end. While the crypto industry views it as progress toward clarity, critics argue it prioritizes industry interests over public safeguards.