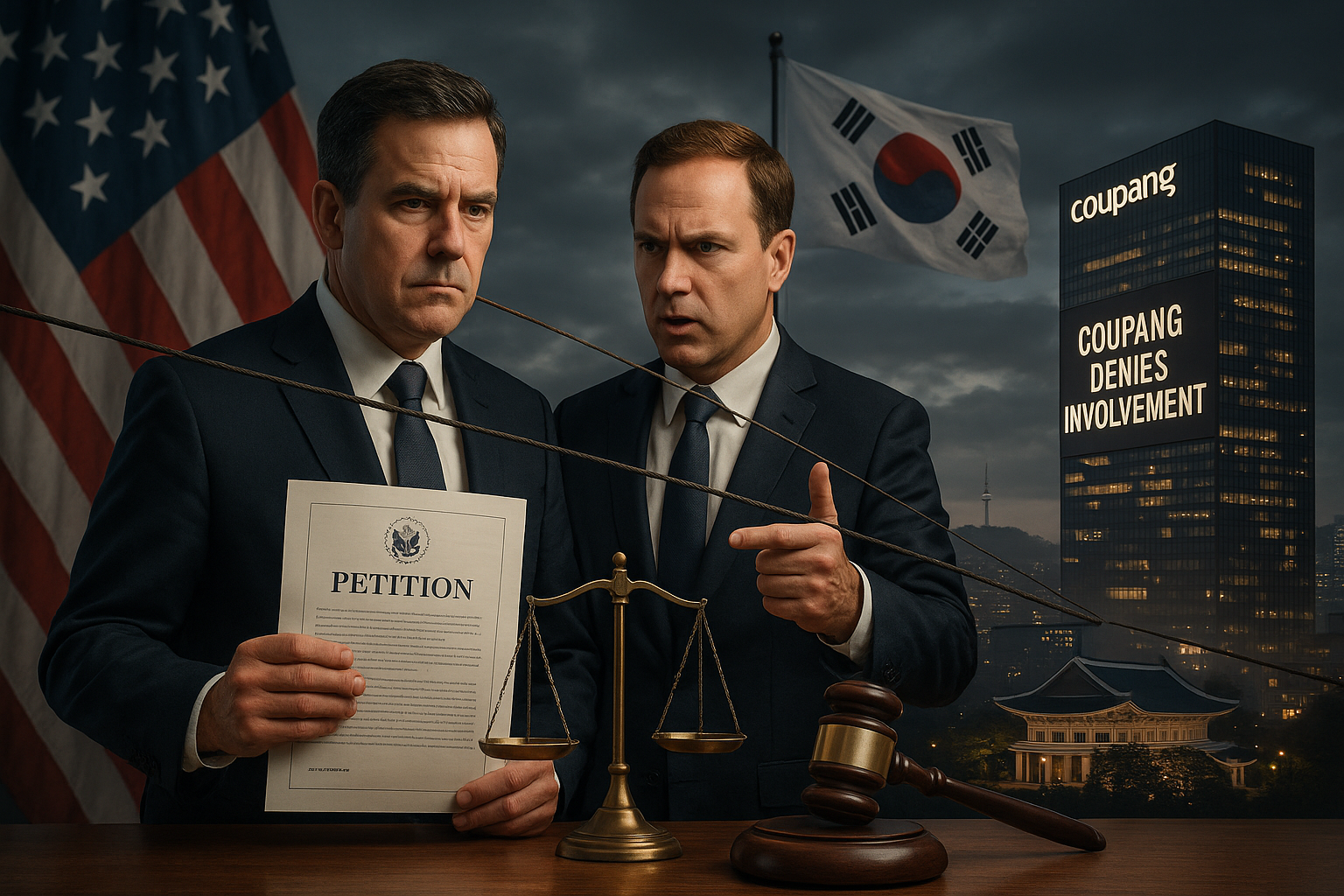

Two U.S. investors have petitioned the U.S. government for an investigation into alleged discriminatory treatment of Coupang by South Korean authorities and notified Seoul of intent to file arbitration claims. Coupang denied any involvement in the petition. The South Korean government refuted claims of discrimination against the company.

On January 23, two U.S. investment firms, Greenoaks Capital Partners and Altimeter Capital Management, criticized South Korean authorities' investigations into Coupang's November customer data breach as 'discriminatory' and took action. The firms petitioned the Office of the U.S. Trade Representative (USTR) under Section 301 of the Trade Act of 1974 to investigate and impose appropriate trade remedies. They also notified the South Korean government of their intent to initiate Investor-State Dispute Settlement (ISDS) arbitration proceedings under the U.S.-South Korea Free Trade Agreement (KORUS FTA). The investors, holding equity interests in Coupang worth over $1.5 billion, claimed the government's 'targeted and hostile interference' caused billions in lost market capitalization.

Coupang stated it has no involvement in the submission. The data breach is believed to have affected about 33.7 million customers, though Coupang maintains the perpetrator accessed data from only around 3,000 accounts. South Korean authorities and experts are probing the incident, which the presidential office described as unprecedented in scale and in line with applicable laws, cautioning against interpreting it as a broader trade issue with the United States.

Prime Minister Kim Min-seok, during a meeting with U.S. lawmakers in Washington on January 23 (local time), asserted, 'There is no discrimination against Coupang whatsoever.' His office refuted claims that his December remarks urging strict enforcement against Coupang were distorted, clarifying they were general guidelines to remedy unfair practices in the economy. A federation representing small merchants and self-employed businesses urged Coupang to cease pressuring the Seoul government through U.S. political channels, stating, 'Coupang has put the survival of small merchants and self-employed businesses at risk.' The People's Solidarity for Participatory Democracy (PSPD) condemned the investors' move as an attempt to undermine South Korea's sovereignty.

With Coupang generating about 90 percent of its revenue in South Korea, the dispute highlights potential strains on the U.S.-South Korea alliance.