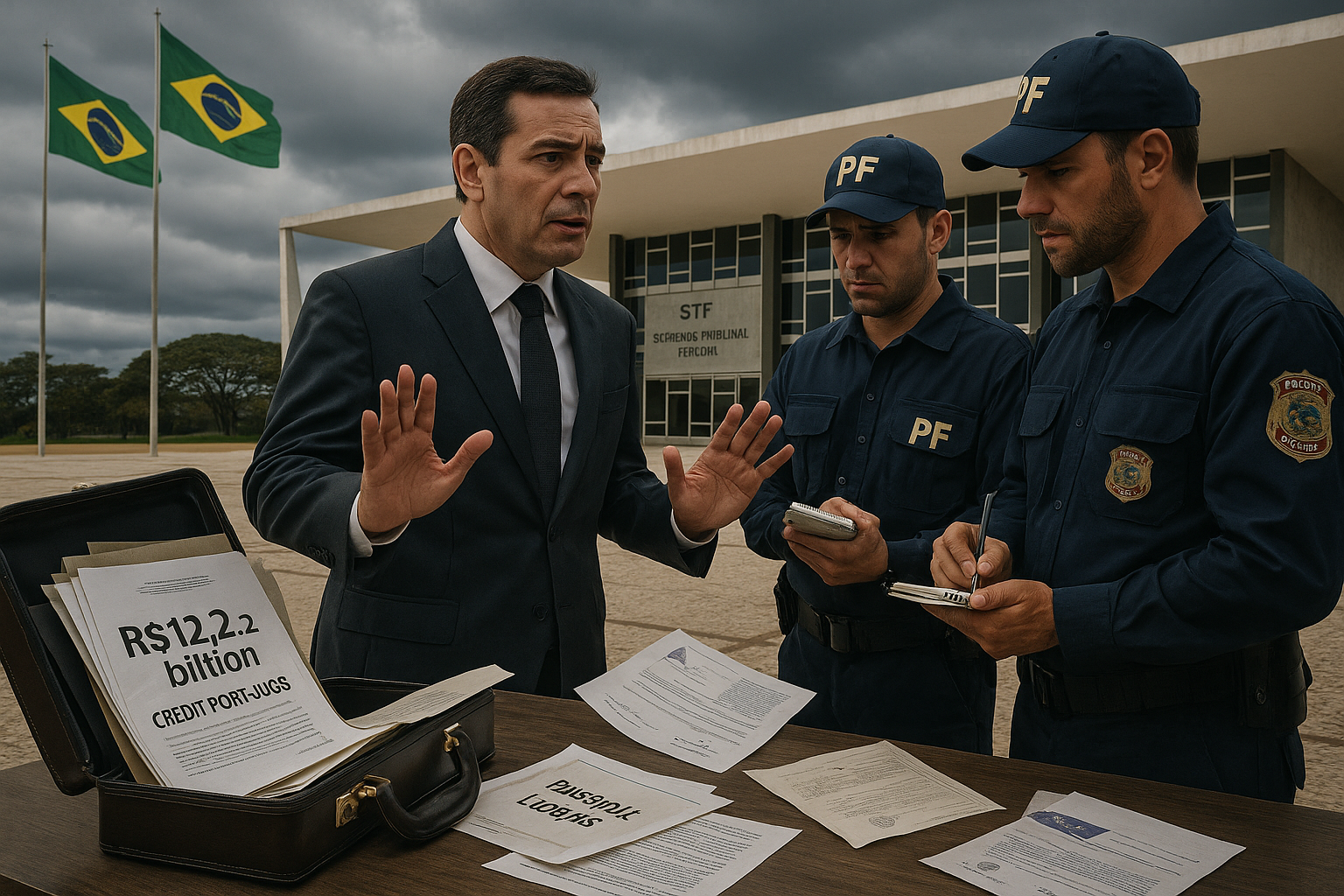

Daniel Vorcaro, owner of Banco Master, denied to the Federal Police having defrauded credit portfolios worth R$ 12.2 billion sold to BRB, claiming he did not know which were good or bad. The portfolios, acquired from Tirreno consultancy, allegedly originated from payroll loans via Bahia public server associations, but indications point to forgery to inflate the bank's balance. The testimony took place on December 30, 2025, at the STF, under the rapporteurship of Dias Toffoli.

Daniel Vorcaro, owner of Banco Master, testified to the Federal Police on December 30, 2025, at the Supreme Federal Court (STF), under the rapporteurship of Minister Dias Toffoli. He denied any fraud in credit portfolios valued at R$ 12.2 billion, sold to the Bank of Brasília (BRB) amid the institution's liquidity difficulties. The portfolios were acquired by Master from Tirreno consultancy, with alleged origins in payroll loan operations through Bahia public server associations.

Investigations by the Central Bank (BC), Federal Public Prosecutor's Office (MPF), and PF indicate the credits were forged, involving CPF numbers from various locations without compatible financial movements in the associations. Vorcaro stated: 'I don't know which credits are good or bad, have documents or not. I have no way of knowing that it wasn't the bank that originated them. And the deal wasn't carried out, after all. So, there was no criminal action by me at any time nor by the bank'.

The banker reported that the BC requested details on the credits' origins in March 2025, and in April Master pressured Tirreno for documentation. In May, upon realizing documents were missing, the contract was unwound, and there were no further dealings with Tirreno. Funds intended for payment remained in an escrow account, without effective release. Vorcaro claimed he did not master payroll operation details at the time and that the bank acted diligently, without classifying the transaction as a sale until convinced of complete documentation.

The testimony preceded a confrontation with former BRB president Paulo Henrique Costa. Toffoli ordered hearings for eight other investigated individuals on January 26 and 27, 2026, in Operation Compliance Zero, to advance the inquiries and protect the financial system. The Master case involves billion-dollar frauds and political ramifications, with the press highlighting its crucial role in exposing conflicts of interest in the Judiciary, such as ties to STF ministers' relatives.

The liquidation of Will Bank, controlled by Master and with 12 million low-income clients, raised doubts about reimbursement. The Credit Guarantor Fund (FGC) estimates R$ 6.3 billion for investors, but prepaid payment accounts do not qualify, with returns via BC deposits without per-client limits.