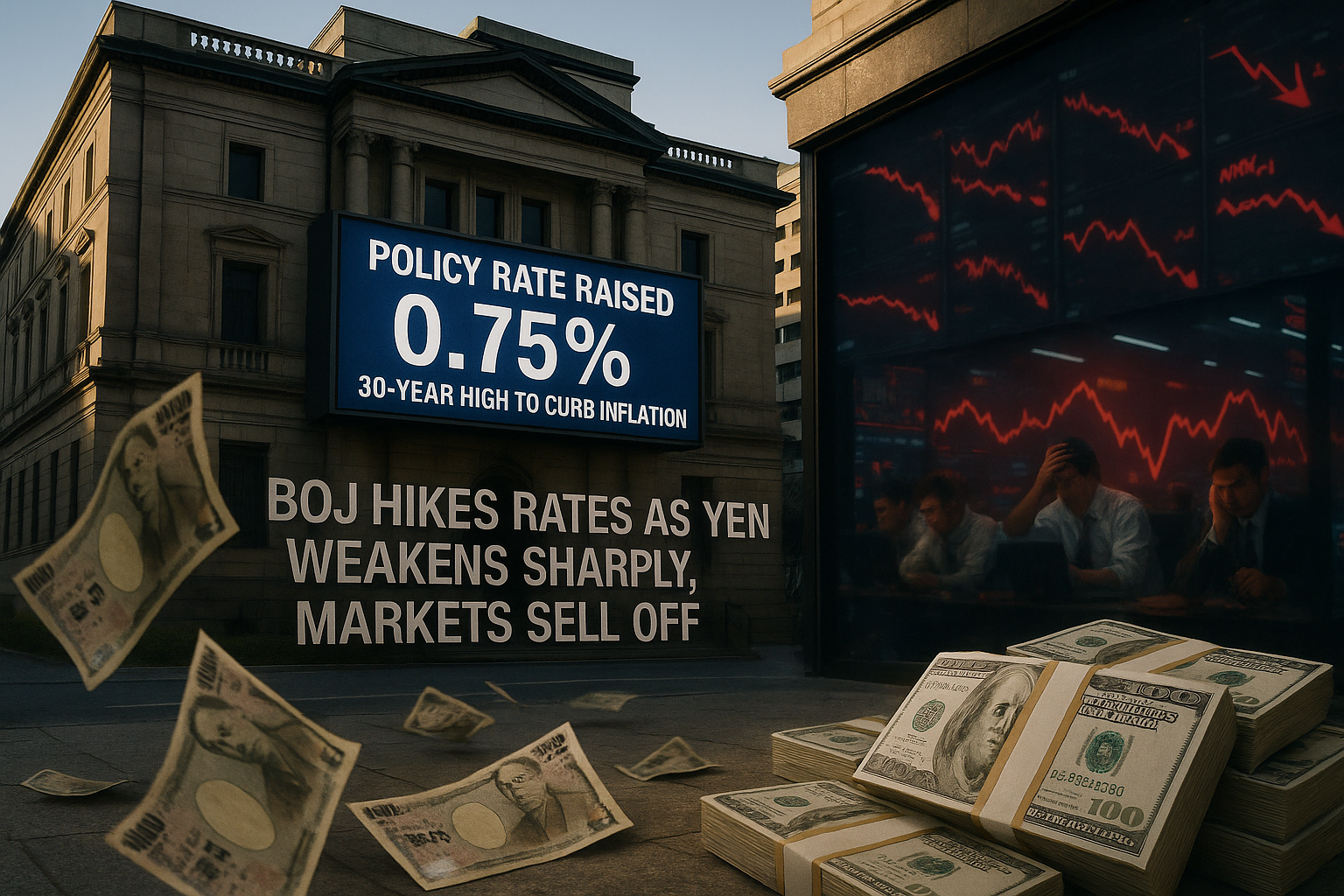

The Bank of Japan raised its policy rate to 0.75% from 0.5% on December 20, marking a 30-year high aimed at curbing inflation. However, the yen weakened sharply against the dollar and other major currencies. Markets reacted with sales due to the BOJ's vague outlook on future hikes.

The Bank of Japan (BOJ) raised its policy rate to 0.75% from 0.5% on December 20, 2025, reaching the highest level since 1995. The move, widely anticipated, aimed to address inflation holding at 3% in November, above the 2% target. However, BOJ Governor Kazuo Ueda remained vague in his post-meeting press conference about the timing and pace of future hikes, stating only that 'the door is open to further tightening.'

The yen fell sharply in response. The dollar surged to a four-week high of 157.67 yen before settling 1.23% higher at 157.535 yen. The euro reached a record 184.71 yen, the Swiss franc an all-time high of 197.23 yen, and sterling climbed 1.36% to 210.96 yen, its highest since 2008. In its statement, the BOJ maintained that underlying inflation would converge around its 2% target in the latter half of the three-year projection through fiscal 2027, noting real rates remained 'significantly low' post-hike.

Market analysts offered mixed views. Marc Chandler, chief market strategist at Bannockburn Global Forex, said, 'The BOJ delivered a rate hike like everybody expected... The yen is weaker across the board. I think many people are saying that the BOJ was not hawkish enough.' Elias Hadad of BBH added in a note, 'In our view, the bar for additional BOJ rate hikes is low,' citing persistent wage and inflation pressures.

Japanese Finance Minister Satsuki Katayama warned, 'We will respond appropriately to excessive moves, including those driven by speculators.' Traders are eyeing potential official intervention, last seen in July 2024 when the dollar hit 161.96 yen. Japan's economy contracted 0.6% in the third quarter, but the BOJ highlighted moderate recovery amid declining U.S. tariff uncertainties. This hike follows the first increase in 17 years in 2024, signaling an end to decades of deflationary pressures. The weak yen has fueled imported inflation, complicating the outlook.