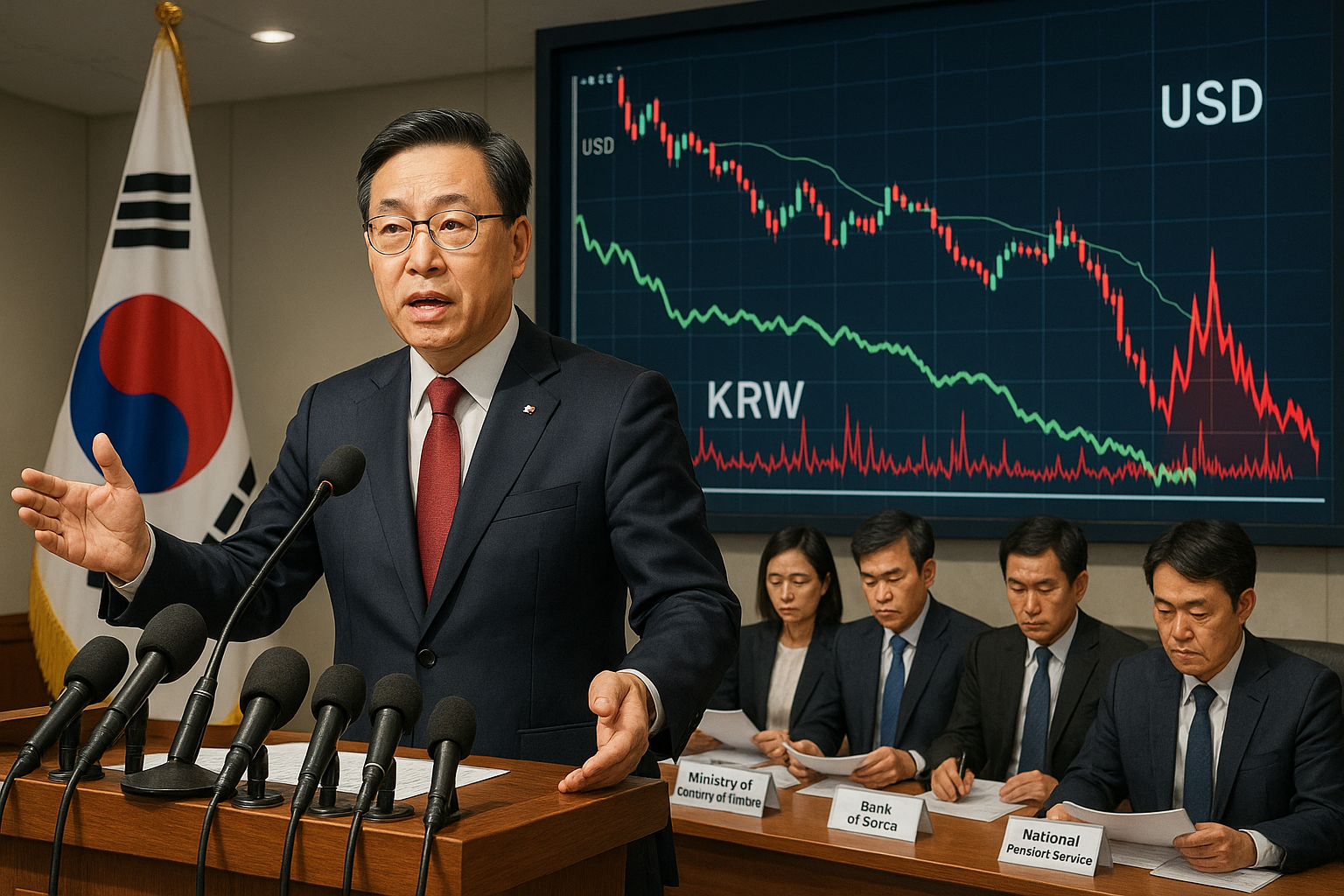

Finance Minister Koo Yun-cheol said on Wednesday that the government will take 'decisive action' if excessive volatility hits the foreign exchange market, as the Korean won continues to weaken against the U.S. dollar. The rapid decline of the won has led the Ministry of Economy and Finance, the Bank of Korea, the National Pension Service, and the Ministry of Health and Welfare to form a joint consultation body. The group aims to create a 'new framework' balancing pension returns with FX stability.

Finance Minister Koo Yun-cheol told reporters on Wednesday that "the won tends to react more sensitively compared with other currencies," adding that FX authorities are closely monitoring speculative trading and one-sided market movements. "We will take decisive action if volatility expands excessively," he stressed.

The won's rapid recent decline has prompted the Ministry of Economy and Finance, the Bank of Korea, the National Pension Service (NPS), and the Ministry of Health and Welfare to form a joint consultation body. The four-way group held its inaugural meeting on Monday to explore ways to balance the NPS' investment returns with stability in the FX market, creating what the minister calls a "new framework."

"Discussions on the new framework are not intended as a temporary measure to mobilize the NPS to counteract the won's depreciation," the minister said. He added the body aims to develop fundamental measures ensuring stable pension payouts without undermining the NPS' profitability, with further discussions on potential medium- to long-term reforms.

The NPS, the world's third-largest pension fund, has a growing overseas portfolio, which market participants have cited as a factor contributing to pressure on the local currency. "As the NPS expands its overseas investments, its impact on the FX market inevitably increases," the minister said, noting that the fund's size already exceeds 50 percent of the country's real gross domestic product (GDP).

He further said that if concentrated overseas investment in the short term leads to inflation or reduced purchasing power, resulting in a decline in real income, the potential negative effects on the domestic economy and public welfare must be considered.

Some analysts have speculated the discussions could include encouraging the NPS to adopt more active currency-hedging strategies, such as selling part of its dollar-denominated overseas assets if the won weakens excessively.

Asked about possible concerns from the U.S. Department of the Treasury, Koo said the U.S. authorities also seem to want stability in the domestic FX market. The Treasury had kept Seoul on its monitoring list for foreign exchange policies in its June report, citing the NPS's growing foreign assets and its $65 billion swap line with the Bank of Korea, suggesting it could be viewed as a tool for currency intervention. Although Korea is not designated as a currency manipulator, it has remained on the list since November 2024.

On incentives for exporters to convert U.S. dollar holdings into Korean won, Koo said such measures can be reviewed if needed. After hitting its weakest level since April, the won strengthened against the dollar for the second consecutive session on Wednesday.