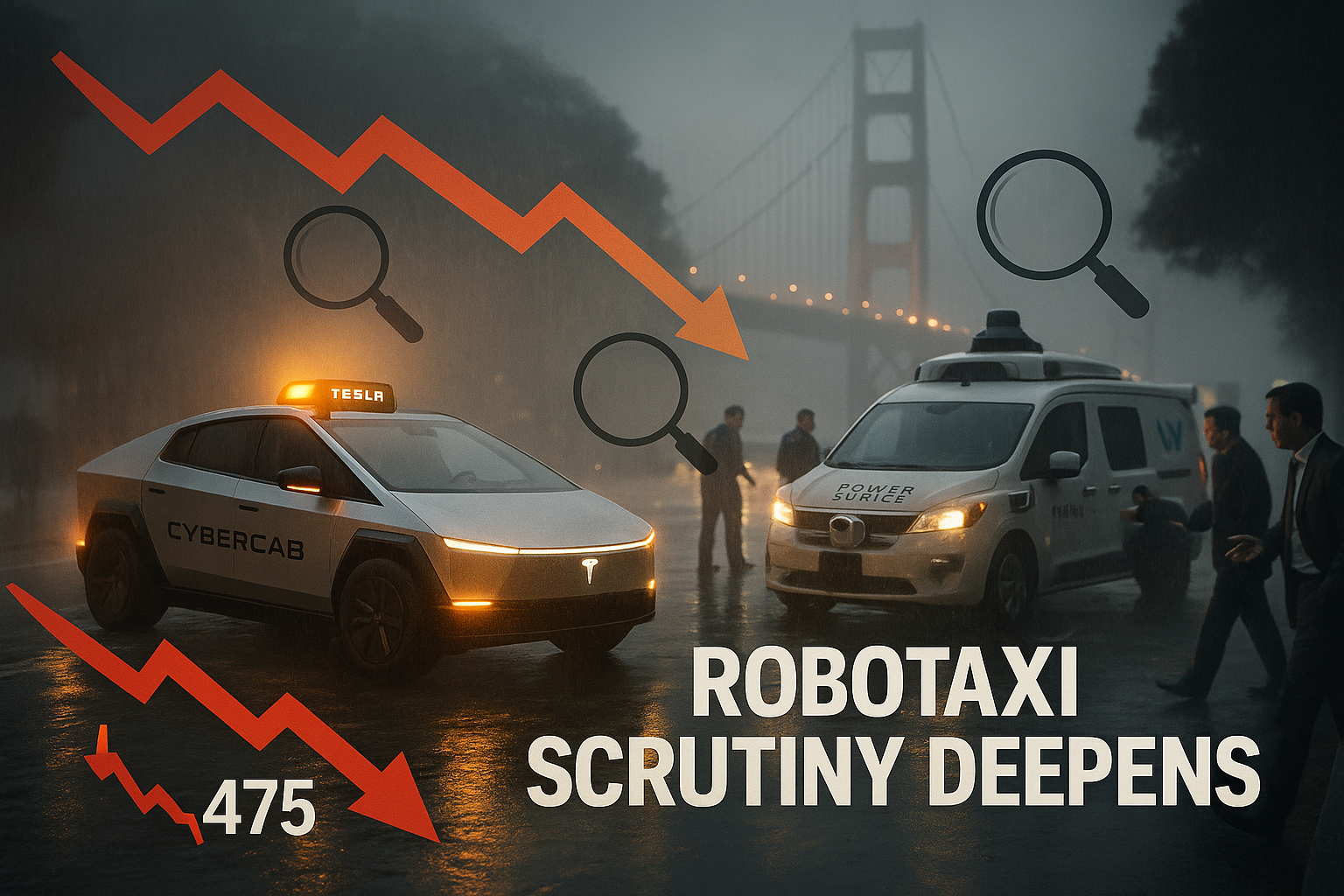

Tesla shares remained under pressure near $475 after Friday's 2.1% drop, as a Waymo power outage in San Francisco reignited regulatory debates on autonomous emergency responses, impacting perceptions of Tesla's robotaxi plans. Positive energy storage news and mixed delivery forecasts provide counterbalance ahead of January 2 figures.

Following recent unsupervised robotaxi tests in Austin and ongoing NHTSA scrutiny of Model 3 emergency doors plus California DMV threats over Autopilot marketing—as covered previously—Tesla's stock traded on thin year-end volume amid heightened focus on autonomous vehicle regulations.

A December 20 power outage in San Francisco halted Waymo robotaxis at failed intersections, prompting California regulators to probe emergency handling and remote teleoperations. Carnegie Mellon professor Philip Koopman urged proof for severe scenarios, while George Mason's Missy Cummings called for federal oversight of remote ops.

Tesla continues pushing Full Self-Driving and robotaxi goals, targeting monitor-free Austin operations by year-end, though public trust trails despite 2025's rising visibility.

Offsetting pressures, Tesla Energy secured a 1 GWh Megapack project in Scotland's Eccles under full EPC with Matrix Renewables; Q3 deployments hit 12.5 GWh. Deutsche Bank lifted its price target to $500 from $470 on robotaxi potential, though consensus remains 'Hold' at $414.50.

Q4 deliveries, due January 2, face YoY decline risks (estimates ~415k-449k vs. prior year), influenced by U.S. incentive changes. Broader markets near S&P 7,000 highs signal volatility resumption, with Fed minutes and Santa Claus rally in focus.