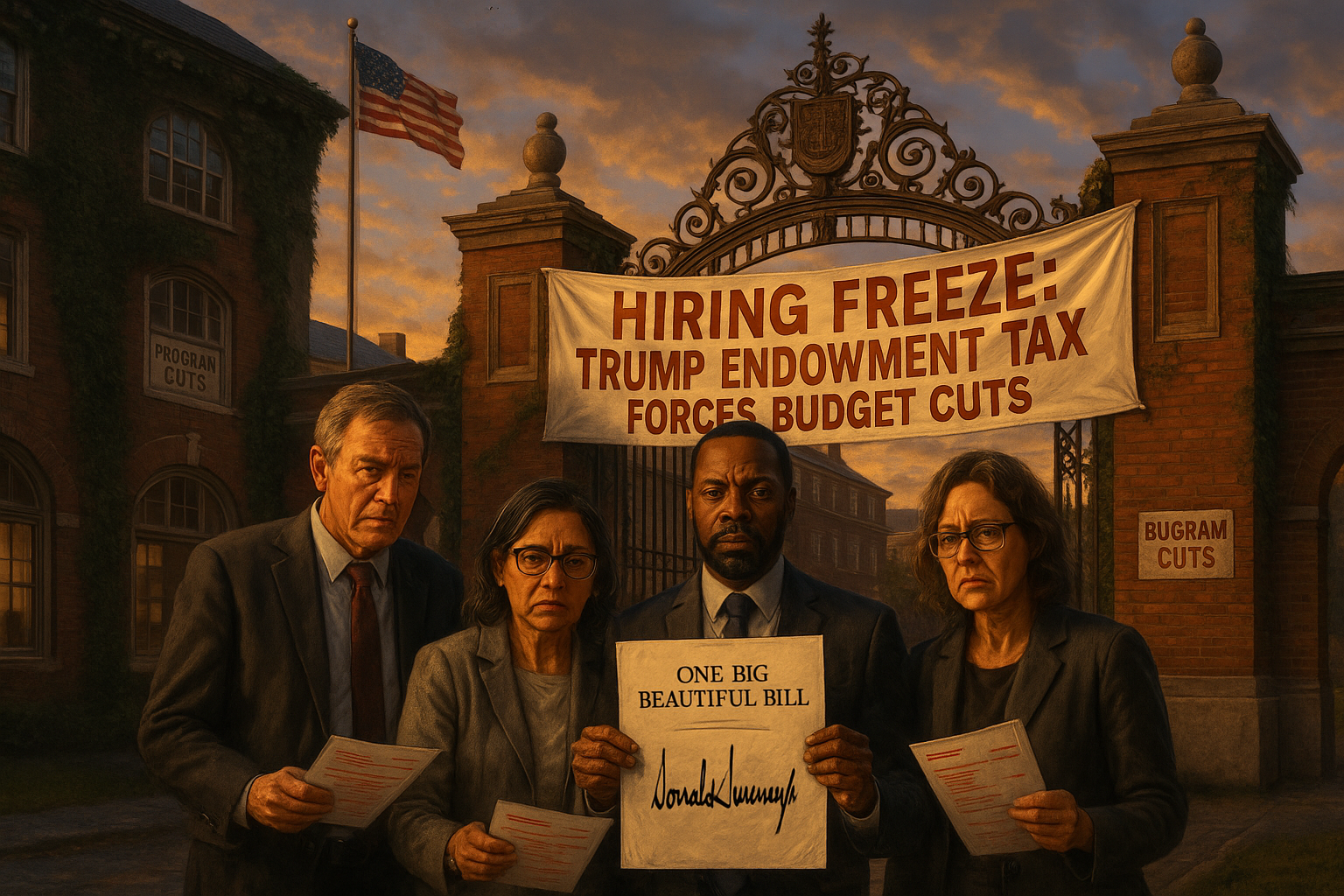

A new tiered federal excise tax on investment income from large private university endowments—enacted in President Donald Trump’s 2025 “One Big Beautiful Bill” and taking effect for tax years beginning after Dec. 31, 2025—is prompting hiring freezes, program cutbacks and renewed debate over whether the policy is aimed at revenue or at reshaping higher education.

In an Independence Day event at the White House, President Donald Trump signed his sweeping tax-and-spending package—often called the “One Big Beautiful Bill”—into law on July 4, 2025. In remarks described by The Nation, Trump touted campaign promises such as eliminating taxes on tips, overtime pay and Social Security benefits for seniors.

Less prominent at the signing was a change with outsized consequences for a small set of private universities: the law replaces the previous flat 1.4% excise tax on certain schools’ net investment income with a tiered system that tops out at 8%. Under the new structure, private institutions with “student-adjusted endowment” assets of more than $2 million per full-time tuition-paying student face an 8% rate; those between $750,000 and $2 million per student face 4%; and those between $500,000 and $750,000 continue to pay 1.4%. The change applies for tax years beginning after Dec. 31, 2025.

The Nation reported that Princeton, Yale and the Massachusetts Institute of Technology would fall into the 8% bracket, while Stanford, Harvard, Notre Dame, Dartmouth, Rice, Vanderbilt and the University of Richmond would be taxed at 4%. Emory, Duke, Washington University in St. Louis, the University of Pennsylvania and Brown would remain at 1.4%, narrowing the affected set to 15 institutions from 56 that were subject to the tax under the 2017 Tax Cuts and Jobs Act.

Universities have said the higher rate could translate into hundreds of millions of dollars in annual costs for the largest endowments. The Nation cited estimates that Harvard and Yale each anticipate roughly $300 million in additional annual costs, and quoted Brookings senior fellow Phillip Levine estimating Princeton’s liability could exceed $223 million in a year.

The policy has intensified a broader political argument about elite campuses. Supporters of higher-endowment taxes have long argued that wealthy schools can afford to contribute more and should spend more on access and affordability. Critics counter that the tax diverts resources away from research and student support. The Nation argued that the burden is concentrated on institutions whose research has helped produce major scientific advances.

Universities are responding in different ways. At Princeton, The Nation reported that departments were asked to plan 5% to 10% budget cuts and that some campus events were being scaled back. The article also quoted Princeton economics professor Owen Zidar as saying the department would pause hiring and planned to reduce its PhD cohort from about 23 students to about 19 because of budget pressures.

At Yale, The Nation reported that President Maurie McInnis imposed a 5% reduction in non-salary expenses, with students citing impacts on support for undergraduate summer experiences and study abroad. The Nation quoted Yale College Council Senate speaker Alex William Chen describing a student petition opposing cuts that, he said, disproportionately affect students receiving financial aid, and quoted Yale sophomore class president Micah Draper blaming the endowment-tax increase for limiting funds that students seek for campus needs.

The debate over spending priorities has extended to faculty governance as well. The Nation quoted Yale professor Daniel Martinez HoSang expressing concern that participation in decision-making over cuts has been uneven.

The Nation also pointed to Yale’s long-running financial relationship with its host city as part of the wider funding picture. It said Yale makes voluntary payments to New Haven “in lieu” of property taxes; separately, Yale Daily News has reported that the university’s existing six-year agreement involves payments of $23.2 million per year, totaling about $135.4 million over the term.

Other institutions have framed the new levy as one component of broader financial pressures that include research-funding uncertainty. MIT President Sally Kornbluth and other senior leaders wrote in a Nov. 19, 2025 letter that MIT estimated the combined budget impact of increased taxes and proposed or current reductions in federal research funding at roughly $300 million per year. The letter said MIT would focus on fundraising, cost reductions such as not renewing leases on unused space and forgoing merit salary increases for employees earning more than $85,000, and encouraging academic units to use certain underutilized gift funds.

The endowment-tax fight has also intersected with the Trump administration’s wider campaign to reshape higher education. In late September 2025, Trump said his administration was close to a deal with Harvard University that would include a $500 million payment and expanded trade-school and skills training—an announcement covered by Reuters and the Associated Press.

How the new endowment tax will affect financial aid, research and campus life over the longer term remains uncertain and is likely to vary by institution, depending on how universities adjust spending, fundraising and enrollment strategies.