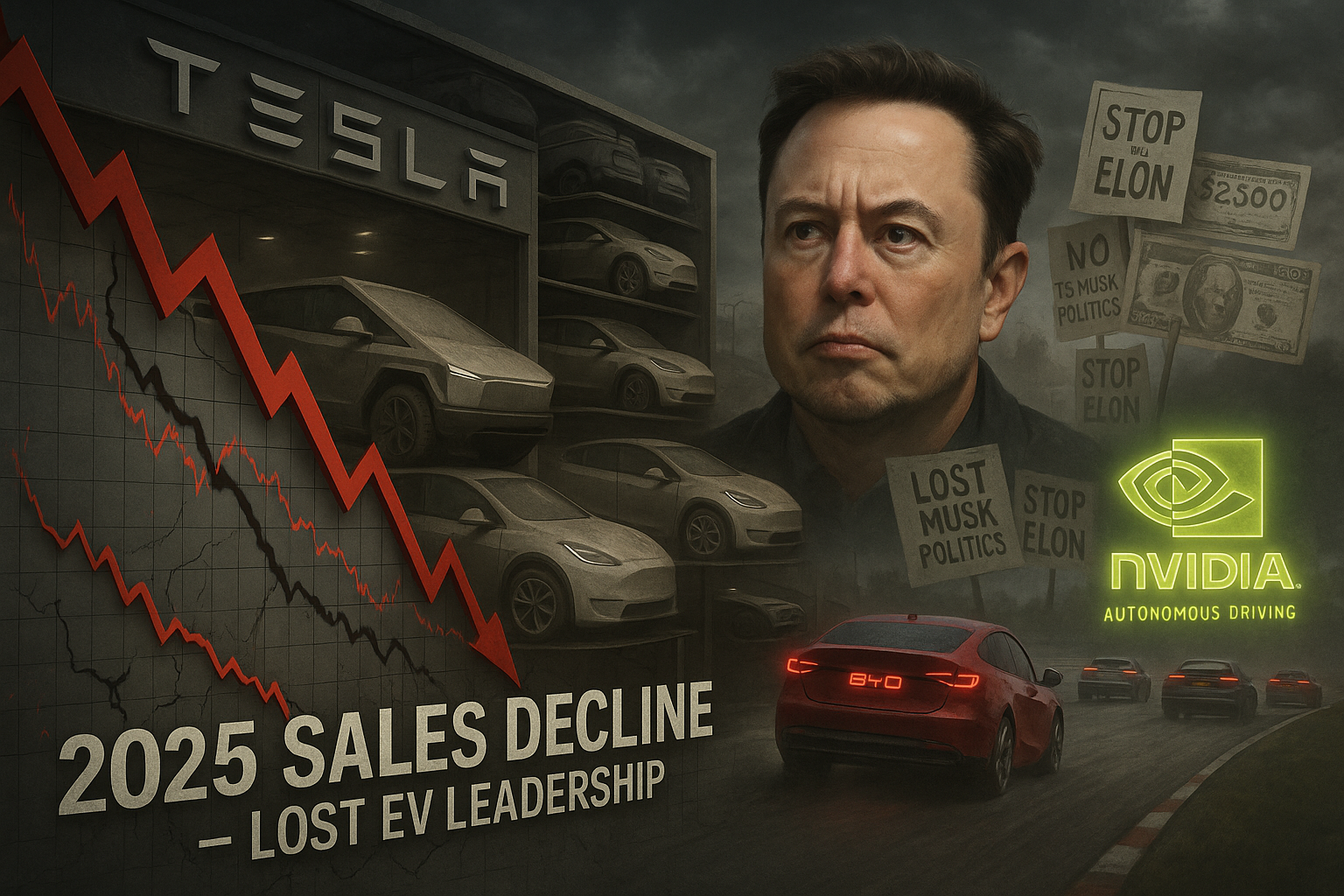

Building on November 2025 slumps across the US, Europe, UK, and China, Tesla's full-year 2025 sales fell for the second straight year, ceding its spot as the world's top EV seller. Key pressures included backlash against CEO Elon Musk's politics, U.S. tax incentive expirations, and surging competition, with shares dropping 5% after Nvidia's open-source autonomous driving reveal.

Tesla reported its 2025 full-year sales on January 6, 2026, confirming a second consecutive annual decline and the end of its global EV sales leadership. This extends the November 2025 drops—19% in the UK, 30% in Europe, 6% in China, and a U.S. plunge below 40,000 units—into a year-long 'bloodbath,' particularly in Europe.

U.S. rivals capitalized: General Motors outsold Ford by over 2-to-1 in EVs, Genesis topped Infiniti and neared Lincoln/Acura, while Lucid's Q4 production more than doubled. Worldwide, challenges mounted from Musk's polarizing right-wing stances sparking customer revolts, the end of federal EV tax credits, and aggressive competition from firms like BYD and emerging Chinese entrants like Geely eyeing U.S. markets in 2-3 years.

Tesla shares tumbled over 5% that day after Nvidia announced open-source AI software for autonomous driving, debuting in Mercedes-Benz's CLA in Q1 2026 and robotaxis next year—threatening Tesla's self-driving advantage. These trends signal broader EV market shifts amid subsidy changes and geopolitical tensions, underscoring Tesla's fading dominance.