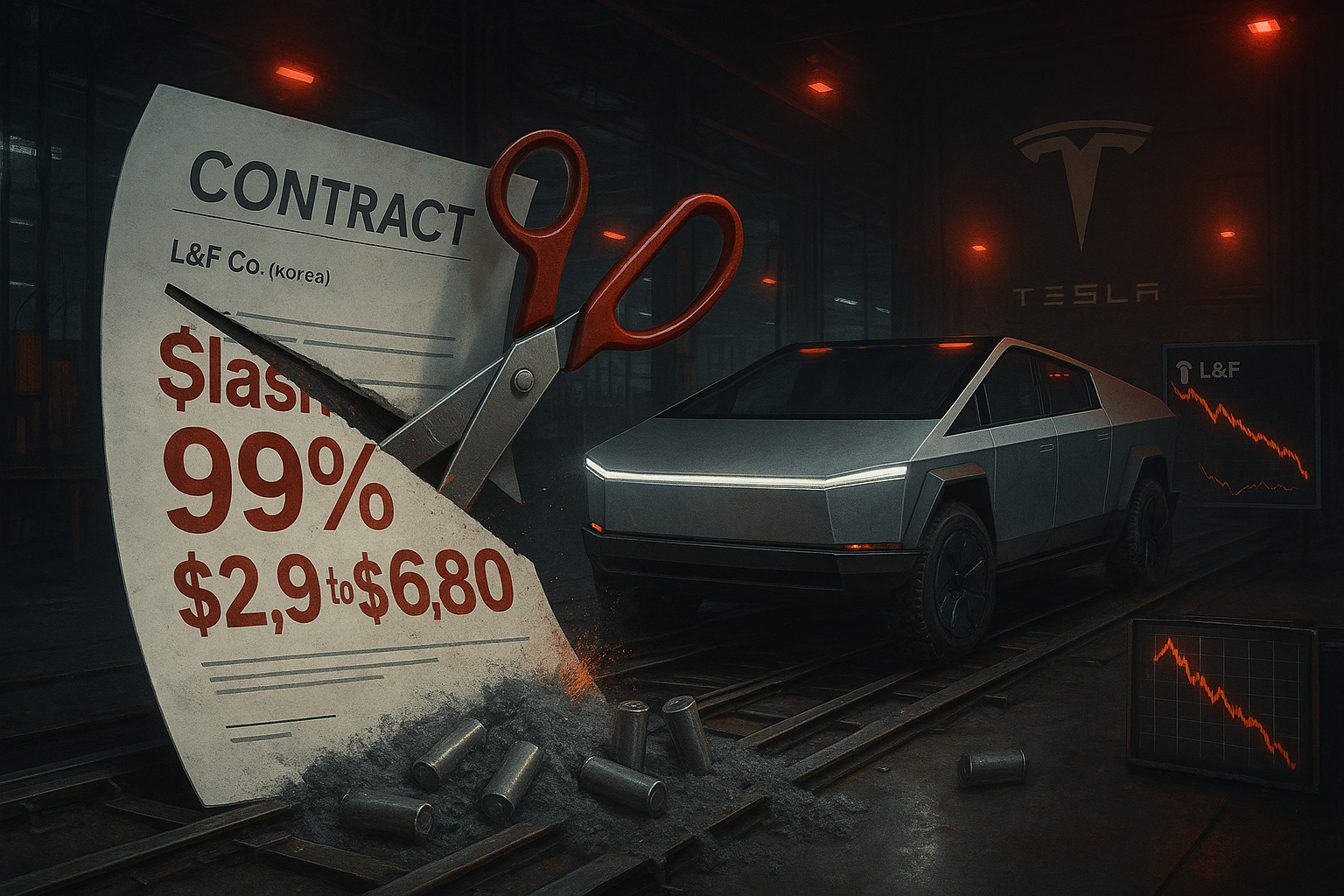

Tesla has slashed its supply deal with South Korean firm L&F Co. by nearly 99%, from $2.9 billion to $6,800, for high-nickel cathode materials used in the struggling 4680 battery cells of the Cybertruck. The revision, filed December 29, 2025, reflects weak demand, production issues, and EV market shifts, impacting L&F's stock and highlighting broader challenges for Tesla's battery ambitions.

South Korean battery materials supplier L&F Co. disclosed in a December 29, 2025 regulatory filing that its February 2023 contract with Tesla—originally worth 3.83 trillion South Korean won (~$2.9 billion)—has been reduced to just 9.73 million won (~$6,800-$7,400 depending on exchange rates). The deal covered high-nickel cathode materials for Tesla's 4680 cells from January 2024 to December 2025, primarily for the Cybertruck.

Unveiled at Tesla's 2020 Battery Day, the 4680 cells promised to halve costs, enable a $25,000 EV, and offer 500+ miles of range. Five years on, scaling issues persist, with dry electrode production yields lagging and use limited to the Cybertruck. Competitors like BMW and Rivian have successfully deployed similar 46XX cells from suppliers including Samsung, LG, and CATL.

Cybertruck sales have disappointed: Tesla targeted 250,000 units annually at Giga Texas but is on track for 20,000-25,000 this year. 2024 premium model sales (Model S, X, Cybertruck) totaled 85,133 units, implying Cybertruck under 30,000. Priced from $79,990—far above the promised $40,000 base—Tesla discontinued the cheapest variant in September 2025 and rolled out incentives like 0% APR financing. The divisive stainless steel design and shifting buyer preferences toward Model 3/Y have contributed to sluggish demand.

L&F attributed the cut to 'changes in supply quantity' amid global EV slowdowns, U.S. Inflation Reduction Act subsidy losses (e.g., $7,500 tax credit), and tariff disruptions. Shipments to other Korean cell makers continue uninterrupted.

Impacts include an 11% weekly and 64% drop in L&F stock since the original contract news. For Tesla, the 4680 program faces uncertainty, with potential Cybercab robotaxi applications stalled by autonomous driving hurdles. In a related move, SpaceX reportedly bought 1,000-2,000 Cybertrucks from Tesla, possibly to clear excess inventory.