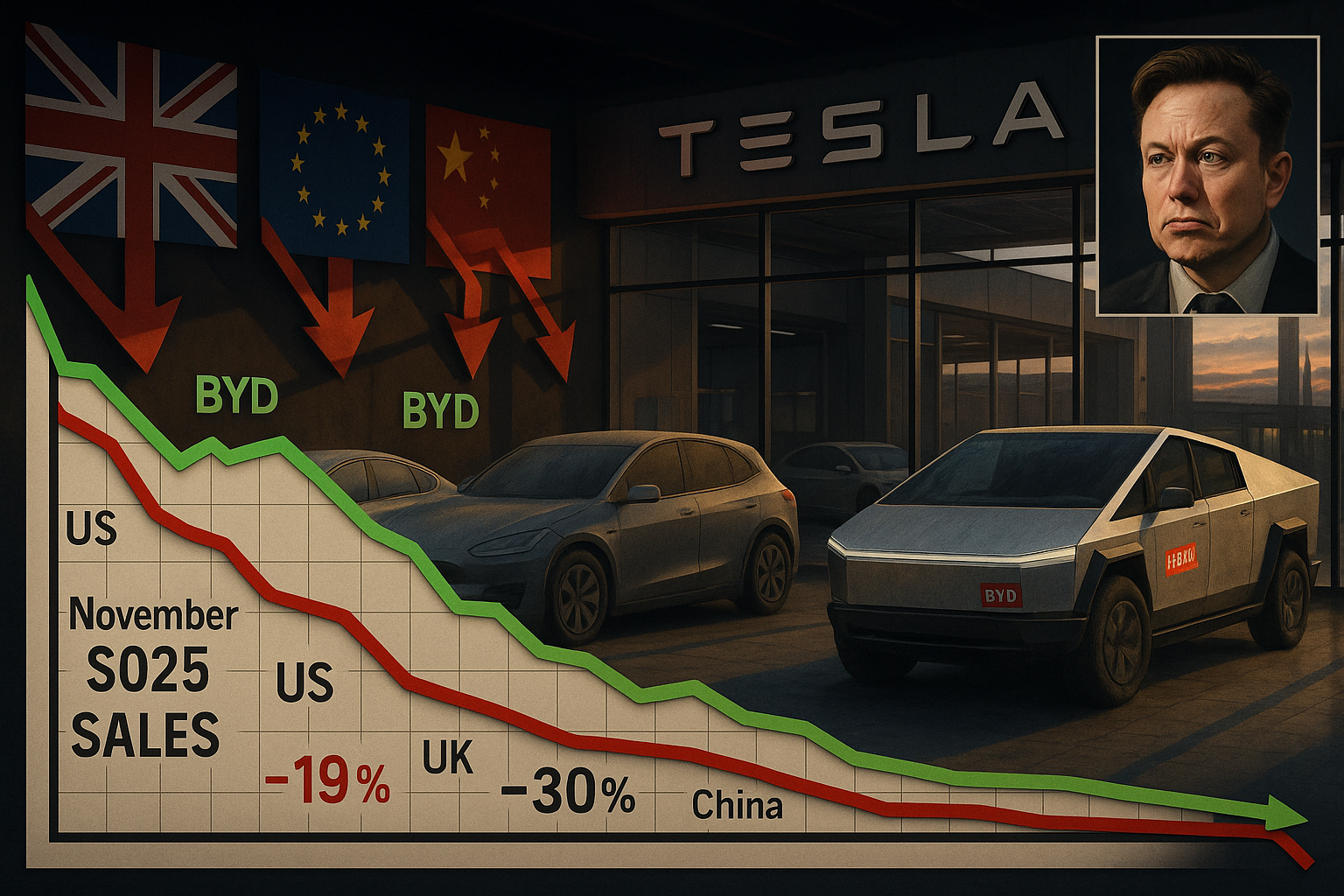

Following the previously reported sharp US sales drop, Tesla saw further declines in November 2025 across the UK (19% fall), Europe (30%), and China (6%), driven by fierce competition from BYD, an aging product lineup, Cybertruck recalls, and CEO Elon Musk's polarizing image.

Tesla's November 2025 challenges extended beyond the US, where sales had already plunged below 40,000 units amid the federal EV tax credit's end and weak demand for new Standard range models.

In the UK, registrations dropped 19% per New AutoMotive data, contrasting with BYD's 229% surge and amid a 6.3% overall new car market dip and 1.1% BEV decline. Europe-wide sales fell 30%, with Model Y posting its worst year after 2023 peaks and softer Model 3 results across countries like Germany, Norway, and the UK.

China, the largest EV market, recorded a 6% Tesla sales drop as locals like BYD gained from incentives. Key factors include Tesla's stagnant lineup since the Cybertruck's November 2023 debut—which hit double-digit recalls by October 2025 over issues like front lights—and Musk's focus on AI/robotics plus political stances, linked to a 15% California dip in Q3 surveys.

UVA's Michael Lenox cautioned Tesla risks becoming the 'Blackberry of EVs' amid slowing global EV growth (20% in 2025, Tesla at 15% share), though laggard traditional automakers offer recovery time versus hybrids, Ford, and Rivian.