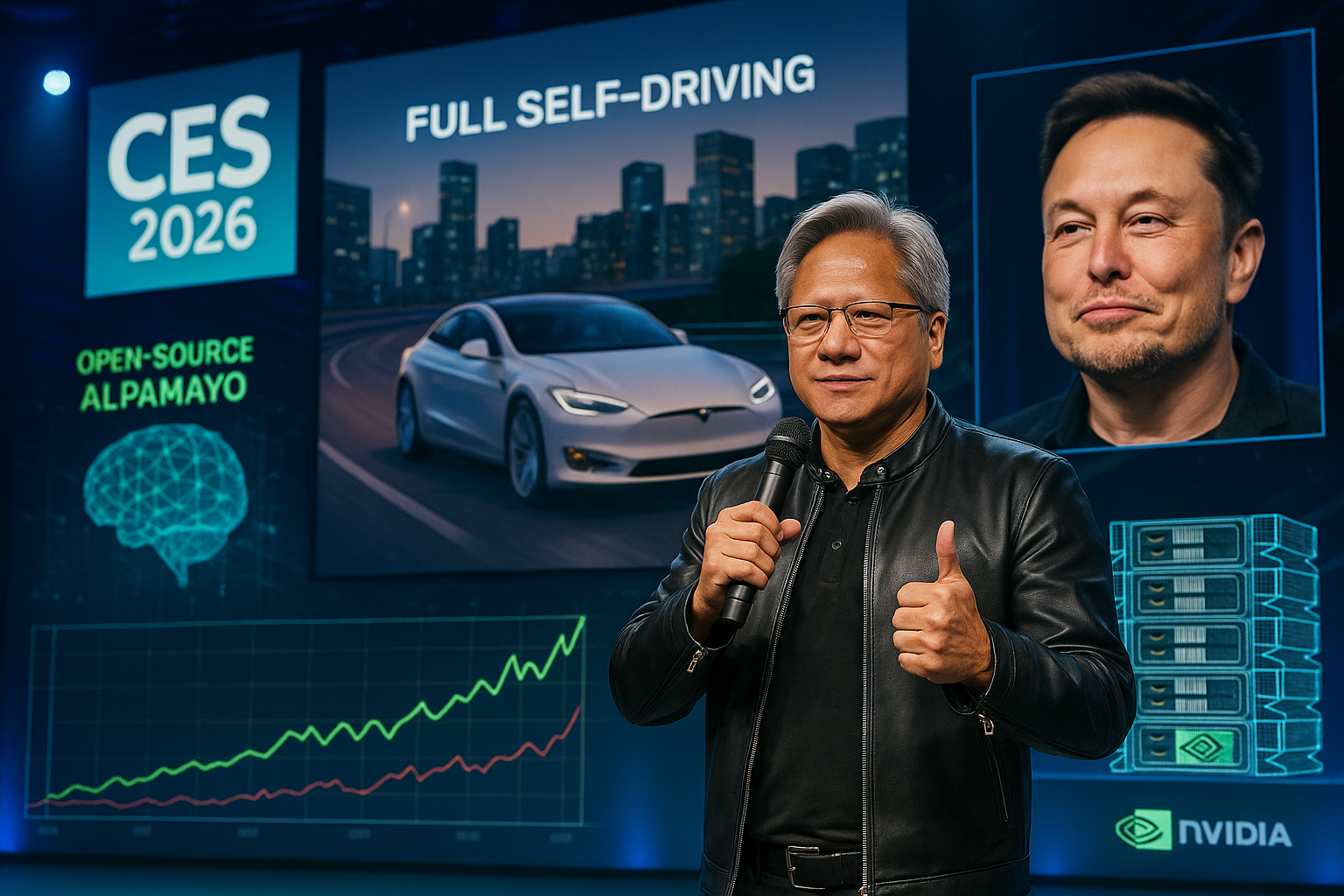

Following its unveiling of open-source Alpamayo AI models at CES 2026, Nvidia CEO Jensen Huang praised Tesla's Full Self-Driving as 'world-class,' while noting strategic differences. Elon Musk dismissed threats to Tesla, revealing hefty Nvidia hardware investments. Analysts see potential challenges to Tesla's self-driving lead amid bullish Nvidia sentiment.

Nvidia CEO Jensen Huang showered praise on Tesla's Full Self-Driving (FSD) technology during the CES 2026 rollout of Alpamayo—a suite of AI models, simulation tools, and datasets for complex road navigation—alongside confirmation that its next-generation Vera Rubin chips have entered full production. Huang called FSD 'world-class' and 'state-of-the-art' across design, training, data, and performance, crediting its end-to-end model trained on vast real-world data. He shared: 'I have it, and I drive it in our house, and it works incredibly well.'

Yet Huang differentiated Nvidia's approach: 'Nvidia doesn’t build self-driving cars. We build the full stack so others can,' offering modular training, simulation, and computing systems. Partners like Tesla, Waymo, XPeng, and Nuro can adopt them flexibly, with models open-sourced to spur industry-wide adoption of advanced autonomy in hundreds of millions of vehicles within a decade.

Tesla CEO Elon Musk countered on X that Nvidia's tech lags years behind Tesla at scale, especially for legacy automakers. He disclosed: 'By the end of this year, Tesla will have spent ~$10B cumulatively just on Nvidia hardware for training,' bolstered by proprietary AI4 chips for efficient video processing.

Altimeter Capital's Freda Duan hailed Alpamayo as an 'Android moment' for autonomy—the first full decision-making stack beyond chips. She pegged Tesla's 2024 training spend at $3-4 billion, scaling to ~$5 billion yearly, but cautioned that broader access could erode its edge. Real tests lie in deployments like Mercedes-Benz's 2026 CLA, limited by current hardware's camera constraints. Tesla presses on with AI5 nearing production, AI6 ahead, and Musk eyeing a massive fab.

Stocktwits reflected 'extremely bearish' Tesla vs. 'bullish' Nvidia sentiment amid high volume, even as Tesla shares rose 5% and Nvidia 30% over the past year.