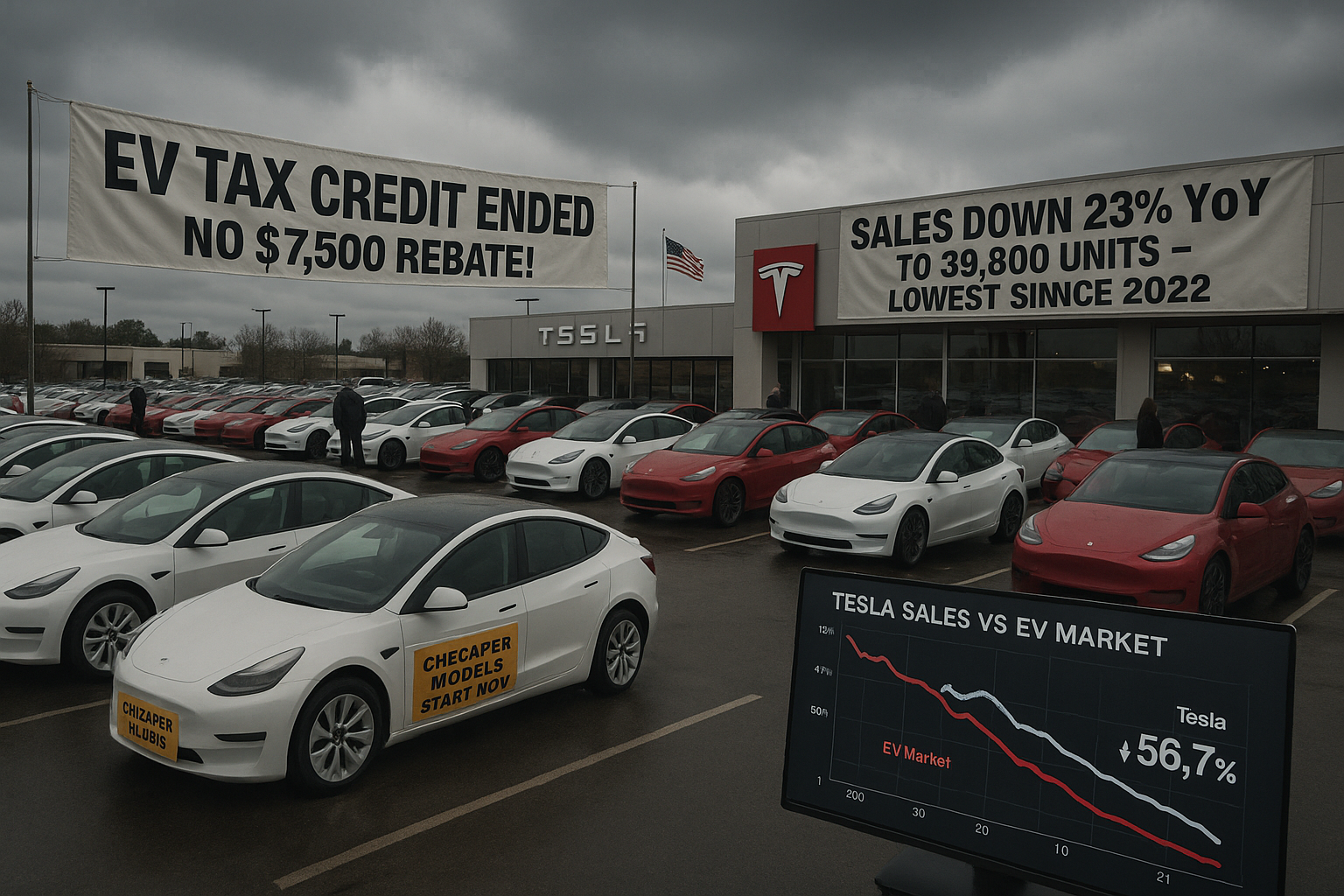

Tesla's US sales dropped 23% year-over-year to 39,800 vehicles in November 2025—the lowest since January 2022—following the $7,500 federal EV tax credit's expiration on September 30. New Standard variants of Model 3 and Y failed to stem the tide amid a broader 41% EV market decline, though Tesla's share rose to 56.7%.

Building on the sharp November US EV sales drop to around 70,000 units, Tesla's performance highlighted policy impacts and strategic missteps. Sales fell from 51,513 in November 2024 (per Cox Automotive estimates), exacerbated by a Q3 rush before the tax credit ended, leading to a post-September slowdown.

Tesla countered with Standard range Model 3 ($38,630) and Model Y ($41,630) in October, but uptake lagged. Cox Automotive's Stephanie Valdez Streaty noted: "The drop shows insufficient demand for Standard variants, which are cannibalizing Premium version sales, especially Model 3."

Promotions including 0% Model Y financing and lease deals underscore weak demand. The Cybertruck added little, aligning with its recent slowdown.

Tesla outperformed rivals in a tough market—high interest rates, competition, and policy shifts favoring gas vehicles—with its share jumping from 43.1% to 56.7%. Analysts say new models are needed to fend off affordable competitors.